It’s important to understand inflation and its effect on interest rate trends. They are key economic indicators that show how well the economy is doing.

The economy sees ups and downs in inflation rates, which changes interest rates. Keeping up with these changes helps you move through the financial market smoothly.

Knowing how inflation impact affects the economy helps you plan for the future. It guides you in making smart financial choices.

Key Takeaways

- Understanding inflation is key to making informed financial decisions.

- Interest rate trends are significantly influenced by inflation rates.

- Staying informed about economic indicators is crucial for financial planning.

- The impact of inflation on the economy can be substantial.

- Being aware of changes in interest rates can help in navigating the financial market.

Understanding Inflation: Definition and Measurement

Inflation is when prices for things we buy go up. It changes how much money we can spend and affects the economy’s health.

What Constitutes Inflation in Economic Terms

Inflation happens when there’s more money or demand for things. This makes prices go up. It can be because of growth, higher costs, or money policy changes.

Consumer Price Index (CPI) and Other Inflation Metrics

The Consumer Price Index (CPI) is a main way to measure inflation. It looks at the price changes of goods and services people buy. Other tools include the Producer Price Index (PPI) and the Personal Consumption Expenditures Price Index (PCEPI).

| Inflation Metric | Description |

|---|---|

| CPI | Tracks consumer prices for a basket of goods and services |

| PPI | Measures the average change in prices of goods and services produced |

| PCEPI | Tracks personal consumption expenditures, including prices and quantities |

Types of Inflation: Demand-Pull vs. Cost-Push

Demand-pull inflation happens when people want more than what’s available. This pushes prices up. Cost-push inflation occurs when making things costs more. Businesses then raise prices to keep profits.

The Basics of Interest Rates in the Modern Economy

Understanding interest rates is key to navigating the financial world. They play a big role in the economy, affecting everything from personal savings to national growth.

Defining Interest Rates and Their Function

Interest rates are the cost of borrowing or the return on savings. Central banks use them to control the economy. Low rates make borrowing cheaper, boosting spending and investment. High rates, on the other hand, increase borrowing costs, slowing growth.

Key Interest Rate Benchmarks in the United States

The Federal Reserve sets key rates, like the federal funds rate. This rate affects other rates in the economy. The prime rate and LIBOR (London Interbank Offered Rate) are also important.

How Interest Rates Affect Borrowing and Lending

Interest rates directly impact borrowing and lending. Higher rates mean higher loan costs for borrowers. Lower rates make loans cheaper. For lenders, higher rates mean more returns on savings and investments.

| Interest Rate Scenario | Effect on Borrowing | Effect on Lending |

|---|---|---|

| Low Interest Rates | Cheaper loans, encouraging spending and investment | Lower returns on savings and investments |

| High Interest Rates | More expensive loans, potentially slowing economic growth | Higher returns on savings and investments |

Alan Greenspan, former Federal Reserve Chairman, said, “The challenge of monetary policy is to interpret the signals that the economy is sending, to understand what they imply for the future, and to act correspondingly.” This shows how crucial interest rates are in managing the economy.

Historical Context: Major Inflation and Interest Rate Cycles

Understanding the past helps us grasp today’s inflation and interest rates. Looking at key historical events shows us what affects these economic signs.

The Great Inflation of the 1970s

The 1970s saw a big jump in inflation, known as the Great Inflation. High oil prices and wage increases led to inflation over 14%. This hurt people’s buying power and economic stability.

Volcker’s Interest Rate Shock and Its Aftermath

Then-Federal Reserve Chairman Paul Volcker raised interest rates sharply in the 1980s. This move cut inflation but caused a deep recession. After, inflation slowly dropped, and the economy became more stable.

Low Inflation Era: 1990s-2019

From the 1990s to 2019, inflation was low and steady. This time had strong economic growth, new tech, and global trade. Interest rates were mostly moderate.

Post-Pandemic Inflation Surge

The COVID-19 pandemic caused big economic problems, like supply chain issues and changed consumer wants. These led to a big inflation rise, like in the 1970s. But the reasons were different. Central banks adjusted policies, including interest rates, to control inflation and keep the economy stable.

The Federal Reserve’s Role in Managing Inflation and Interest Rates

It’s important to know how the Federal Reserve manages inflation and interest rates. The Fed, or Federal Reserve, has a big job. It follows a dual mandate that guides its actions.

The Dual Mandate: Price Stability and Maximum Employment

The Federal Reserve aims to keep prices stable and the economy fully employed. This means controlling inflation and keeping unemployment low. But, controlling inflation can sometimes raise unemployment, and vice versa.

“The Federal Reserve is committed to using its tools to support the economy and achieve its dual mandate of maximum employment and price stability.” – Jerome Powell, Chairman of the Federal Reserve

Monetary Policy Tools at the Fed’s Disposal

The Fed has many tools to manage inflation and interest rates. It sets the federal funds rate and buys or sells government securities. It also sets reserve requirements for banks. These actions help guide the economy.

| Monetary Policy Tool | Description | Impact on Economy |

|---|---|---|

| Federal Funds Rate | The interest rate at which banks lend to each other overnight. | Influences other interest rates and borrowing costs. |

| Open Market Operations | Buying or selling government securities to increase or decrease the money supply. | Affects liquidity and interest rates. |

| Reserve Requirements | The percentage of deposits that banks must hold in reserve rather than lend out. | Influences the amount of credit available in the economy. |

FOMC Decision-Making Process

The Federal Open Market Committee (FOMC) makes monetary policy decisions. The FOMC meets eight times a year. They assess the economy and decide on actions. Their decisions affect interest rates and inflation expectations.

The Federal Reserve’s actions impact the economy a lot. They affect mortgage rates and the dollar’s value. Knowing about the Fed’s role and tools is crucial for investors and policymakers.

Current Inflation and Interest Rate Trends in the United States

It’s vital to keep up with inflation trends and interest rate trends in today’s economy. The U.S. is in a dynamic economic state. Many factors are affecting inflation and interest rates.

Recent Inflation Data and Analysis

The latest inflation data paints a mixed picture. Some areas see big price hikes, while others stay steady. The Consumer Price Index (CPI) has seen ups and downs due to economic changes.

- The CPI has gone up by 2.5% in the last year. This is mainly because of higher housing and energy costs.

- Core inflation, which doesn’t count food and energy, is also rising. This shows there are still inflation pressures.

Current Federal Funds Rate and Treasury Yields

The Federal Funds Rate, set by the Federal Reserve, is now between 1.50% and 1.75%. This rate affects other interest rates, like Treasury yields. The yield curve, showing Treasury bond interest rates against their maturities, is watched for economic signs.

- The 10-year Treasury yield has climbed to 2.3%. This shows people think the economy will keep growing.

- Short-term Treasury yields have also gone up. This is because of the current Federal Funds Rate and what people think will happen next.

Sectoral Price Changes and Their Significance

Looking at sectoral price changes helps us understand inflation’s drivers. Recent data shows big differences in various sectors.

- Housing costs keep going up, adding a lot to inflation.

- Energy prices swing a lot, affected by global events and supply chains.

- Prices in the tech sector have dropped. This is because of better efficiency and more competition.

Grasping these trends is key for investors, policymakers, and consumers. It helps them make smart choices in today’s economy.

The Relationship Between Inflation and Interest Rates

It’s important for investors and policymakers to understand how inflation and interest rates work together. This relationship affects the health of an economy.

How Central Banks Use Interest Rates to Control Inflation

Central banks, like the Federal Reserve in the U.S., use interest rates to fight inflation. They change the federal funds rate to influence interest rates in the economy. This affects borrowing costs and spending.

Mechanisms of Control:

- Raising interest rates to curb inflation by reducing borrowing and spending

- Lowering interest rates to stimulate economic growth during periods of low inflation

Real vs. Nominal Interest Rates

It’s key to know the difference between nominal and real interest rates. The nominal interest rate is the rate for lending or borrowing without adjusting for inflation.

The real interest rate is the nominal rate adjusted for inflation. It shows the true cost of borrowing or the real return on savings.

| Interest Rate Type | Description | Impact |

|---|---|---|

| Nominal Interest Rate | The rate charged or earned without adjusting for inflation | Affects borrowing costs and savings returns as per market conditions |

| Real Interest Rate | Nominal rate adjusted for inflation | Reflects the true cost of borrowing or the real return on savings |

The Concept of the Neutral Rate

The neutral rate, or the natural rate of interest, is the rate that keeps economic growth steady. It keeps inflation in check. This rate is theoretical and can change with economic conditions.

Understanding the link between inflation and interest rates is complex. It involves looking at many economic indicators and forecasts. Central banks adjust their strategies to keep the economy stable. It’s crucial for everyone to stay updated.

Impact of Inflation on Consumer Purchasing Power

It’s important to know how inflation affects our money’s value. As inflation goes up, our money buys less. This section looks at how inflation changes what we can buy, focusing on wages, prices of essentials, and ways to keep our buying power.

Wage Growth vs. Inflation

Wage growth and inflation are key to our spending power. If wages rise faster than inflation, we can buy more. But if inflation grows faster, we spend less.

Wage Growth vs. Inflation: A Comparative Analysis

| Year | Wage Growth (%) | Inflation Rate (%) | Purchasing Power Change |

|---|---|---|---|

| 2020 | 2.5 | 1.8 | Increased |

| 2021 | 3.0 | 2.2 | Increased |

| 2022 | 2.8 | 3.5 | Decreased |

Essential Goods and Services Price Trends

Inflation changes prices of different items in different ways. Things like food, housing, and healthcare often get more expensive when inflation is high.

Price Trends for Essential Goods:

- Food prices increased by 5% in 2022.

- Housing costs rose by 7% in the same year.

- Healthcare expenses saw a 4% increase.

Strategies for Maintaining Purchasing Power

To fight inflation’s effects, we can use a few strategies. Investing in things like commodities or real estate can help. Also, having a varied investment portfolio and adjusting our spending can make a difference.

Understanding inflation’s impact on our money helps us make better financial choices. This way, we can protect our financial health.

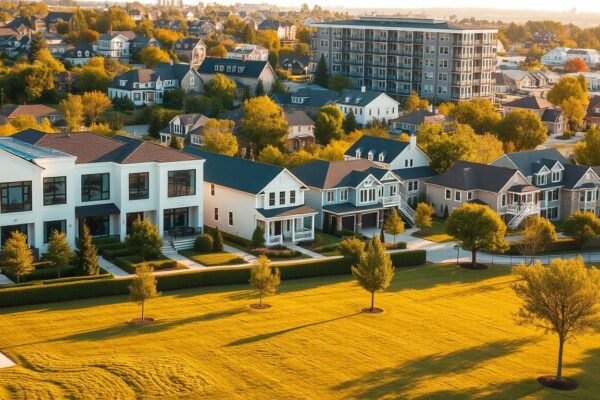

How Interest Rate Fluctuations Affect Mortgages and Housing

It’s key to know how interest rate changes affect mortgages. This is true for both homeowners and those looking to buy. The way mortgage rates move is linked to interest rates. This can greatly change how affordable housing is.

Mortgage Rate Trends and Forecasts

Mortgage rates have seen ups and downs lately. This is due to the economy and decisions by the Federal Reserve. Right now, rates are higher than they were a decade ago. Experts think rates might keep changing based on inflation and the Fed’s moves. Homebuyers should keep an eye on these trends.

Housing Affordability Calculations

Housing affordability depends on mortgage rates, house prices, and how much people earn. When interest rates go up, borrowing costs rise. This might make it harder for some to buy a home. Buyers need to think about the home’s price, mortgage rates, and their own finances.

Refinancing Considerations in Different Rate Environments

For homeowners, refinancing might be a good choice in some interest rate situations. If rates fall a lot, refinancing can save a lot of money. But, if rates are going up, it might be better to look at other financial plans or wait for rates to drop.

Inflation and Interest Rate Impacts on Retirement Planning

Inflation and interest rates are key factors in retirement planning. As people get closer to retirement, knowing how these factors work together is vital. It helps keep their finances stable.

Effect on Fixed Income

Inflation can lower the value of fixed incomes, like pensions or annuities. This makes it hard for retirees to keep up with their living costs. For example, a $50,000 yearly income might not cover expenses if inflation goes up by 3% each year.

Impact on Purchasing Power: A 3% inflation rate can cut a fixed income’s buying power by 3% yearly. This can greatly reduce a retiree’s ability to buy what they need.

Social Security Cost-of-Living Adjustments

Social Security benefits get an annual increase based on the Consumer Price Index (CPI). These cost-of-living adjustments (COLAs) help keep the value of Social Security benefits steady.

| Year | COLA Percentage | Average Monthly Benefit |

|---|---|---|

| 2020 | 1.6% | $1,503 |

| 2021 | 1.3% | $1,555 |

| 2022 | 5.9% | $1,657 |

Retirement Portfolio Strategies

Retirees need to adjust their investment plans based on interest rates. For example, in a rising rate environment, short-term bonds or floating-rate investments might be better.

Strategy Considerations: Mixing fixed income, stocks, and alternative investments in a portfolio can help against inflation and rate changes.

Understanding how inflation and interest rates affect retirement planning helps people make better financial choices. This way, they can protect their financial future.

Investment Strategies During Various Inflation and Interest Rate Scenarios

Investors must adjust their plans as the economy changes. It’s key to know how different assets do in different times. This helps make smart choices for your money.

Asset Classes That Typically Perform Well During High Inflation

Some assets do better when inflation is high. Commodities like gold and oil often gain value. Real estate also does well, as property values and rents can rise with inflation.

Fixed Income Strategies in Rising Rate Environments

When interest rates go up, fixed income investors need to change their approach. Investing in short-duration bonds can help, as they’re less affected by rate changes. Another option is floating-rate notes, which can profit from higher rates.

Equity Sector Performance During Different Inflation Regimes

Different sectors of the stock market do better in different times. For example, energy and materials sectors do well in high inflation. On the other hand, technology and healthcare sectors might shine in low inflation times.

Alternative Investments as Inflation Hedges

Alternative investments can protect against inflation. Infrastructure investments often offer stable returns that keep pace with inflation. Private equity and real assets are also good choices, as they can grow and pass on costs to consumers.

| Asset Class | High Inflation Performance | Low Inflation Performance |

|---|---|---|

| Commodities | Strong | Weak |

| Real Estate | Strong | Moderate |

| Energy and Materials Stocks | Strong | Weak |

| Technology and Healthcare Stocks | Weak | Strong |

Knowing how assets and strategies perform in different times helps investors. This knowledge is key to protecting and growing your money.

Analyzing Current Inflation and Interest Rate Trends for Investors

Investors need to understand current inflation and interest rate trends. These factors greatly affect how well investments do.

Interpreting Economic Indicators

Important economic indicators like the Consumer Price Index (CPI), Gross Domestic Product (GDP), and unemployment rates are key. They help investors see how the economy is doing.

Key indicators to watch include:

- CPI and inflation rate forecasts

- Federal Reserve announcements on interest rates

- GDP growth rates and economic output

Sector Rotation Strategies Based on Rate Expectations

Sector rotation means changing your investment mix based on rate and inflation changes. For example, when rates go up, financials might do well. But during inflation, commodities and real estate could be better choices.

Investors should consider the following sector rotation strategies:

- Shifting to interest-rate sensitive sectors during rate hikes

- Investing in inflation-resistant assets during high inflation

- Diversifying across sectors to mitigate risk

Portfolio Rebalancing Considerations

Rebalancing your portfolio is key when inflation and interest rates change. It’s important to check your portfolio often. This ensures it still matches your goals and risk level.

Rebalancing strategies may include:

- Adjusting asset allocations in response to interest rate changes

- Reallocating investments to sectors that are likely to benefit from current trends

- Maintaining a diversified portfolio to minimize risk

Demographic Impacts of Inflation and Interest Rate Changes

Inflation and interest rate changes affect different people in different ways. It’s important to understand these effects to make smart financial choices.

Effects on First-Time Homebuyers

First-time homebuyers face big challenges when interest rates go up. Higher rates mean more expensive borrowing, making homes harder to buy. This can slow down the housing market.

But, when rates drop, buying a home becomes cheaper. This can boost the housing market. First-time buyers should:

- Look at mortgage options in different rate times

- Think about how inflation affects home prices

- Check if homes are still affordable

Implications for Retirees on Fixed Incomes

Retirees with fixed incomes struggle with inflation. Inflation can be tough for retirees who count on fixed income. It makes their money worth less over time.

To fight this, retirees might need to change their investments. Or find new ways to earn money that keeps up with inflation.

Generational Wealth Transfer Considerations

Inflation and interest rate changes also affect passing wealth from one generation to the next. Changes in rates can change the value of inheritances. For example, higher rates might make it harder for younger people to borrow money.

This could lessen their chances of getting financial help from older family members. Important things to think about include:

- How rate changes affect estate planning

- The role of inflation in the value of inherited wealth

- Strategies for passing wealth to the next generation

Global Perspectives on Inflation and Interest Rates

Looking at inflation and interest rates around the world shows different trends and challenges. As the world’s economy links together, it’s key for investors, policymakers, and shoppers to grasp these differences.

Comparative Analysis of Major Economies

The economic scene in big countries like the U.S., the European Union, Japan, and growing markets like China and India is mixed. For example, the U.S. has seen inflation rise after the pandemic. But the European Union’s economy has grown slowly, affecting its inflation and interest rates.

| Country/Region | Inflation Rate (%) | Interest Rate (%) |

|---|---|---|

| United States | 2.5 | 4.75 |

| European Union | 1.8 | 3.25 |

| Japan | 1.2 | 0.10 |

| China | 2.0 | 3.45 |

Currency Implications of Divergent Monetary Policies

Different monetary policies in countries affect currency exchange rates. For instance, when the U.S. Federal Reserve raises interest rates, it can make the dollar stronger. This can impact international trade and investment.

Currency Fluctuations: A stronger currency can make exports pricier, which might slow down economic growth. But a weaker currency can help exports but raise the cost of imports.

International Investment Considerations

Investors need to look at global inflation and interest rates when deciding where to put their money. Spreading investments across different countries and types of assets can help reduce risks from inflation and rate changes.

Key Considerations:

- Keep an eye on central bank actions and economic signs

- Spread investments across different places and sectors

- Think about investments that protect against inflation and do well in high inflation times

By understanding global inflation and interest rates, investors and policymakers can make better choices. They can navigate the complex world economy more effectively.

Future Scenarios: Projecting Inflation and Interest Rate Trends

Looking ahead, it’s key to understand inflation and interest rate trends. This knowledge helps investors and consumers make smart financial choices.

Short-Term Forecasts and Market Expectations

In the short term, inflation forecasts rely on current economic data. This includes commodity prices and supply chain issues. Market expectations show a cautious view on inflation in the next few months.

- Commodity price volatility

- Supply chain recovery

- Monetary policy adjustments

Medium-Term Economic Projections

Medium-term projections suggest inflation rates might stabilize. This is as global supply chains recover and monetary policies kick in. Interest rates will balance economic growth and inflation control.

“The Federal Reserve’s commitment to controlling inflation will be a key factor in shaping interest rate trends in the medium term.”

Long-Term Structural Factors Affecting Rates

Long-term trends, like demographic changes and technological advancements, shape inflation and interest rates. Knowing these factors helps in making long-term financial plans.

By studying these trends and keeping up with economic forecasts, people can handle the financial world’s complexities better.

Practical Financial Decisions in Today’s Economic Environment

Understanding the modern economy requires careful financial planning. We face challenges like inflation and changing interest rates. Making smart financial choices is key to stability and growth.

Timing Major Purchases and Loans

Timing is everything when it comes to big buys and loans. With rates going up, locking in lower rates for things like mortgages might be wise. But, you should also think about your financial situation and the market.

| Loan Type | Current Interest Rate | Recommended Action |

|---|---|---|

| Mortgage | 6.5% | Consider locking in rates if financially ready |

| Auto Loan | 7.0% | Evaluate need vs. want; consider alternative options |

| Personal Loan | 9.0% | Assess urgency and explore lower-rate alternatives |

Savings and Investment Allocation Strategies

High inflation means we need to rethink how we save and invest. Putting money into things like TIPS or real estate can protect our buying power.

Debt Management in the Current Rate Environment

Managing debt well is crucial when rates are rising. Focus on paying off high-interest debt first. Look into debt consolidation or balance transfers to lessen the blow of higher rates.

By carefully planning big purchases, adjusting your savings and investments, and managing debt, you can handle today’s economic challenges with confidence.

Conclusion: Navigating the Future of Inflation and Interest Rates

Understanding inflation and interest rates is key for smart financial choices today. The Federal Reserve uses monetary policy to control inflation, setting interest rates as a tool.

The current trends show a complex economic scene. Investors and consumers need to stay alert and adjust their plans as the economy changes. Knowing about the Consumer Price Index and the Federal Funds Rate is vital for understanding the future.

As the economy keeps changing, staying updated on inflation and interest rates is crucial. This knowledge helps with making smart decisions on investments, mortgages, or retirement. Being aware of these indicators can help you stay financially stable and successful in an uncertain future.

FAQ

What is inflation, and how is it measured?

Inflation is when prices for goods and services keep going up over time. It’s measured by the Consumer Price Index (CPI). This index looks at the average price changes in items people buy.

How do interest rates affect borrowing and lending?

Interest rates change how much it costs to borrow money and how much you get when you lend it. When rates go up, borrowing gets pricier. This might slow down spending and investing. But when rates drop, borrowing is cheaper, which can help the economy grow.

What is the relationship between inflation and interest rates?

Central banks use interest rates to fight inflation. Higher rates can cut down on demand, helping to lower prices. But lower rates can boost the economy, but might also raise prices.

How does inflation impact consumer purchasing power?

Inflation means your money doesn’t go as far as it used to. It’s harder for people with fixed incomes or those who don’t get raises to keep up with prices.

What are the implications of interest rate changes for mortgages and housing?

Interest rate changes can really affect how much you pay for a mortgage. Lower rates make mortgages cheaper, which can help the housing market. But higher rates make borrowing more expensive, which might slow down the market.

How do inflation and interest rates affect retirement planning?

Inflation can eat away at the value of your retirement savings. Interest rates also play a big role in how much you can earn on your savings. It’s important for retirees to understand these to keep their lifestyle.

What investment strategies are effective during periods of high inflation?

When inflation is high, things like commodities, real estate, and Treasury Inflation-Protected Securities (TIPS) often do well. Spreading out your investments can help protect against inflation.

How do demographic changes influence the impact of inflation and interest rates?

Different people are hit in different ways by inflation and interest rate changes. For example, first-time homebuyers might feel the pinch of higher mortgage rates. But retirees on fixed incomes worry more about inflation’s effect on their buying power.

What are the global implications of divergent monetary policies on inflation and interest rates?

When countries have different monetary policies, it can cause currency shifts and affect global investments. It’s key for investors with international portfolios to keep an eye on these changes.

How can individuals make practical financial decisions in the current economic environment?

People should think carefully about when to buy big things or take out loans. They should also adjust their savings and investments based on interest rate expectations. And managing debt well is crucial in today’s rates to make smart financial choices.